Understanding Foreign Exchange Risk Management for SMEs: Practical Strategies

Introduction

Ever wondered why your impeccably profitable transnational deal suddenly turned into a financial services headache? Welcome to the world of foreign exchange risk, where currency oscillations can make or break your bottom line faster than you can say “exchange rate.”

For small and medium enterprises (SMEs) venturing into international trade finance, understanding FX risk is not just smart business — it’s survival. Nearly every SME is an international business these days, and you might be wondering how to reduce your FX threat. Exchange rates change all the time, and keeping track of them is a futile task unless you’re backed by strong risk management instruments.

What Exactly Is Foreign Exchange Risk?

This is the threat posed by fluctuations in exchange rates that could affect payments and bills in foreign currency. Think of it as the unpredictable guest at your trade finance party — you never know when it will show up or what damage it might cause.

There are three main types of FX threat that SMEs face:

Transaction Risk

The most common malefactor, arising from the time pause between agreeing to a deal and actually getting paid. Your agreed-upon profit margin could dematerialize if currencies move unfavorably during this window — unless you’re using hedging via a forward contract or backed by a bank guarantee for payment.

Translation Risk

If you have subsidiaries abroad, consolidating financial statements becomes a currency conversion mystery that can produce phantom earnings or losses — an area best supported by trade credit finance solution experts.

Economic Risk

The broader impact of currency movements on your company’s market value and cash flows, frequently triggered by macroeconomic shifts or geopolitical events — often needing risk mitigation in trade finance solutions to remain stable.

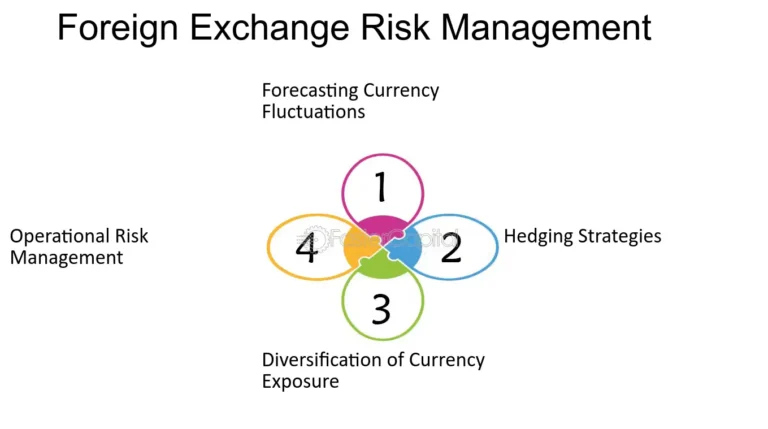

Four Practical Strategies to Tame Currency Volatility

1. Master the Art of Matching and Netting

Here’s a simple yet impactful tactic: Matching and netting refer to the process of coordinating reciprocal FX workflows to reduce FX exposure. Instead of executing multiple currency deals, consolidate opposing cash flows to minimize your exposure. If your EU company needs to send $1 million to the US but simultaneously expects $1.5 million back, net the flows and handle just the $500,000 difference.

Tools such as MT700 and MT799 are often used in large corporate transactions and can also support such coordinated payments through trusted Financial Instruments for Trade.

2. Build FX Protection into Your Contracts

Smart SMEs don’t leave currency risk to chance. Include specific clauses in your contracts that address how currency fluctuations will be managed. Define the base currency and set exchange rate limits or adjustment mechanisms. These clauses can save you thousands when markets move against you — especially when backed by letter of credit services or a standby letter of credit from your Trade Finance Bank.

3. Embrace Local Currency Deals

One of the most effective risk management instruments? Simply transact in local currencies whenever possible. Open multi-currency accounts to collect payments in your clients’ home currencies, then transfer funds in bulk. This approach transforms 100 individual FX exposures into one manageable transaction — often streamlined via Documentary Collections and trade credit provider platforms.

4. Leverage Financial Instruments

Don’t shy away from professional financial instruments provider support. Forward contracts, FX options, and flexible forwards might sound complex, but they are powerful tools in your trade finance partnerships arsenal. Whether you need a letter of credit from bank, performance bank guarantee, or pof proof of funds, these instruments help lock in favorable rates and provide secure payment guarantees.

Your Next Step Forward

Currency risk management is often misunderstood or neglected by SMEs. Any business that purchases or sells products (or services) in multiple currencies should consider strategies to mitigate FX rate volatility.

Start by reviewing your current payment cycles and exposures. Talk to your trade finance company or advisor about options like pof bank, warranty bond service, or even MT760 for large-scale secured deals.

The question is not whether you will face currency risk — it’s whether you’ll be prepared. Which of these strategies resonates most with your current business challenges? Start with one, master it, then expand your toolkit as your global trade solutions evolve.